Business Impact of Carbon and Environmental Taxes

The previous five articles in this series introduced the topic of carbon taxes and environmental levies, providing an overview of key terms, definitions, forms, and concepts. What is apparent is that these taxes are designed to align economic incentives with environmental objectives by imposing costs on activities that generate negative ecological outcomes. Even though the environmental rationale is clear, the financial consequences for business are often not discussed in everyday conversations.

Nonetheless, for companies engaged in global and local markets, environmental and carbon taxes translate into real costs that influence pricing, margins, supply chains, and competitive strategies. To better understand these taxes and their impact on businesses both direct and indirect, it is necessary to distinguish between the legal liability these taxes impose on specific economic actors and the economic reality of how the burden is distributed across the value chain.

Environmental Taxes: From Legal Liability to Economic Impact

Environmental taxes and levies come in many forms, such as point‑of‑sale charges, product‑specific taxes, or fees tied to producer responsibility schemes, each designed to influence behaviour through economic incentives. Even though these liabilities legally fall on the producers and importers who place taxed goods on the market, the economic burden of these taxes can extend far beyond the immediate liable persons, affecting suppliers, producers, importers, and retailers.

UK's Plastic Packaging Tax

One practical example of the impact of environmental taxes on businesses is the UK Plastic Packaging Tax (PPT), introduced in April 2022, which imposes a tax on plastic packaging components containing less than 30% recycled plastic. As of April 1, 2025, the rate is set at GBP 223.69 per tonne.

The main objective of the PPT is to incentivize the use of recycled plastic by making packaging with low recycled content more costly. To meet this objective, the tax applies to both plastic packaging produced in the UK and imports that do not meet the minimum 30% recycled content threshold. Consequently, PTT affected around 20,000 businesses across a wide range of sectors, particularly those operating in consumer goods, food and beverage, and manufacturing.

One of the main effects on suppliers of plastic and related materials is reduced demand and pressure to offer recycled alternatives to help their customers avoid higher tax liabilities. As a result, the cost of raw materials shifts depending on the market mix of recyclable versus so-called virgin plastics, and businesses that cannot adjust quickly face higher input costs.

UK’s Packaging Extended Producer Responsibility

To fully understand the burden of environmental taxes on businesses, we will keep focus on the UK's legislation and its Packaging Extended Producer Responsibility (pEPR). The pERP establishes obligations for businesses based on their annual turnover and the volume of packaging they handle in the UK. Businesses are separated into two groups: small and large producers, with thresholds determined by both turnover and the tonnage of packaging supplied or imported.

Small producers are businesses, excluding charities, with an annual turnover exceeding GBP 1 million that supply or import more than 25 tonnes of packaging. Large producers, which also exclude charities, are those with a yearly turnover exceeding GBP 2 million that supply or import more than 50 tonnes of packaging.

Under the pERP, businesses supplying packaging to UK end users, including those importing goods or operating online marketplaces, must register and report packaging data through the government’s RPD portal. From January 2025, large producers must also pay fees covering administration and disposal costs, calculated according to packaging type and recyclability.

Effects of Environmental Taxes on Retailers

Even though they are not often directly impacted by environmental taxes, retailers ultimately feel the economic impact through margin pressures and pricing decisions. In cases where producers and importers choose to pass the cost of environmental taxes down the chain, retailers face the strategic decision of whether to absorb those costs to remain competitive or raise consumer prices. In the end, this decision affects competitiveness, sales volume, and customer perceptions.

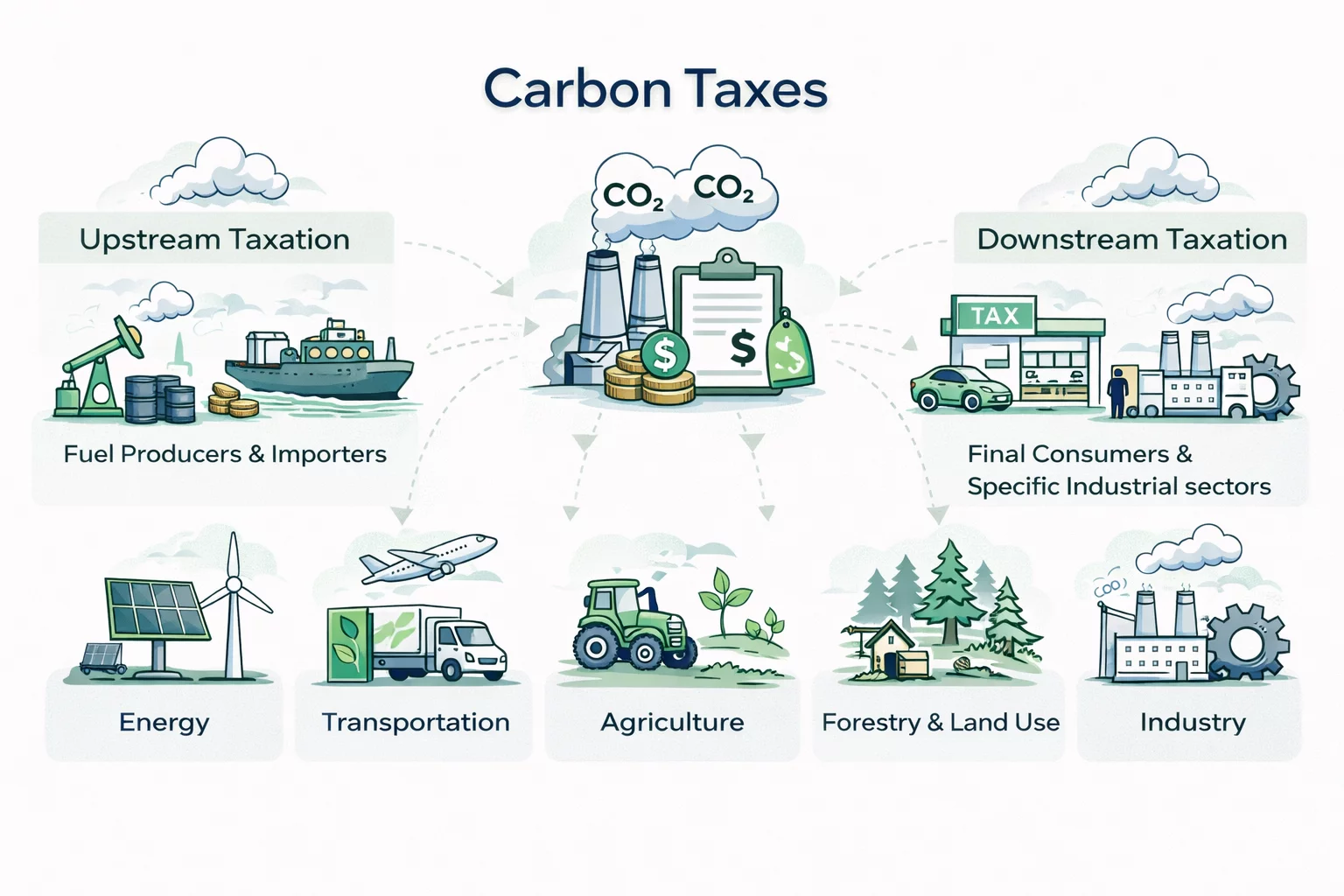

Carbon Taxes and Their Impact Across the Business Value Chain

Carbon taxes, by design, impose a cost on carbon dioxide (CO₂) emissions generated by businesses, usually based on the quantity of emissions produced. These taxes are often applied directly to energy producers, industrial facilities, or sectors with high greenhouse gas (GHG) emissions, but, like environmental levies, they also cascade through the value chain.

Carbon Taxes and Their Influence on Production and Supply

To start from the top. Since carbon taxes increase the cost of fossil fuel consumption and industrial emissions, the first affected businesses are energy suppliers and primary producers. Businesses that operate energy-intensive plants must factor in the additional tax on every unit of fuel or electricity used, which, ultimately, raises production costs. Thus, the direct correlation between cost and liability is clear: those responsible for the emissions must pay the tax.

Nonetheless, apart from this direct impact, the broader economic consequences can extend further. For example, intermediate producers who purchase energy or energy-intensive inputs from suppliers face higher input costs under carbon taxes.

The increase in input cost may further put pressure on margins. This is particularly true in competitive sectors where absorbing costs is difficult. Consequently, these producers may shift their supply relationships toward less carbon-intensive suppliers to reduce the effective tax burden embedded in their inputs, altering demand for various upstream products and services.

How Carbon Taxes Impact Importers?

The EU’s Carbon Border Adjustment Mechanism (CBAM) serves as a perfect example of a mechanism intended to level the playing field between domestic producers subject to carbon pricing and foreign producers from countries without equivalent mechanisms. Under CBAM, importers of carbon-intensive goods, such as iron, steel, cement, and aluminum, must provide quarterly reports of the GHG emissions embedded in their imports.

Moreover, EU importers are required to account for the carbon emissions embedded in the goods they bring into the market, effectively imposing a carbon cost on foreign-produced inputs. Even though the CBAM aims to target compliance and reporting obligations, the economic impact includes higher costs for goods with high emissions profiles and competitive effects on traditional supply chains.

Retail Implications of Carbon Taxes

Retailers and downstream businesses can experience the indirect consequence of carbon taxes through the pass-through effect. If suppliers and producers decide to pass increased costs on to retailers, retailers face either higher procurement costs or weaker margins. Whether retailers may pass these costs to consumers depends on the sector. For example, for products with inelastic demand, carbon taxes may be largely passed through to the end consumer. In contrast, in competitive markets, producers and retailers typically absorb these costs.

Conclusion

From suppliers and producers to importers and retailers, these taxes influence costs, pricing strategies, margins, and competitiveness, creating a web of direct and indirect economic impacts. Understanding the dynamics and distribution of these taxes across the supply chain is essential for businesses seeking to manage expenses and maintain market positioning. However, for businesses, investing in sustainable practices, improving recyclability, or reducing carbon intensity is an opportunity to innovate and gain a strategic advantage.

Source: PwC - Environmental Taxes and Regulations, PwC - The CBAM: Creating a Global Carbon Regime, OECD - Tax and the environment, UK HM Revenue & Customs - Plastic Packaging Tax, UK Department for Environment, Food & Rural Affairs and Environment Agency, VATabout - The EU Carbon Border Adjustment Mechanism (CBAM)

Suppliers and producers face higher input costs, pressures to provide recycled or low-impact materials, and operational adjustments to manage compliance and reduce tax liabilities.

Energy suppliers, industrial facilities, and high-emission sectors are directly impacted, while intermediate producers, importers, and retailers experience indirect effects.

CBAM requires importers of carbon-intensive goods to report embedded emissions and account for associated carbon costs, influencing procurement decisions and overall supply chain costs.

It depends on the market. For inelastic-demand products, costs are often passed on to consumers, whereas in competitive markets, businesses may absorb some or all of the expenses.

The impact of environmental and carbon taxes can be mitigated by investing in sustainable practices, reducing emissions, improving recyclability, and optimizing supply chains. This way, businesses can lower costs and gain strategic advantages.

Recognising how taxes affect each stage of the supply chain helps businesses manage costs, make informed pricing decisions, and maintain competitiveness in markets subject to environmental and carbon taxes.