VAT in the MENA Region

Discover the complexities of VAT in the MENA region, including implementation status, varying rates, and compliance challenges across countries like Saudi Arabia, UAE, Algeria, and Jordan.

Glossary

Executive Summary

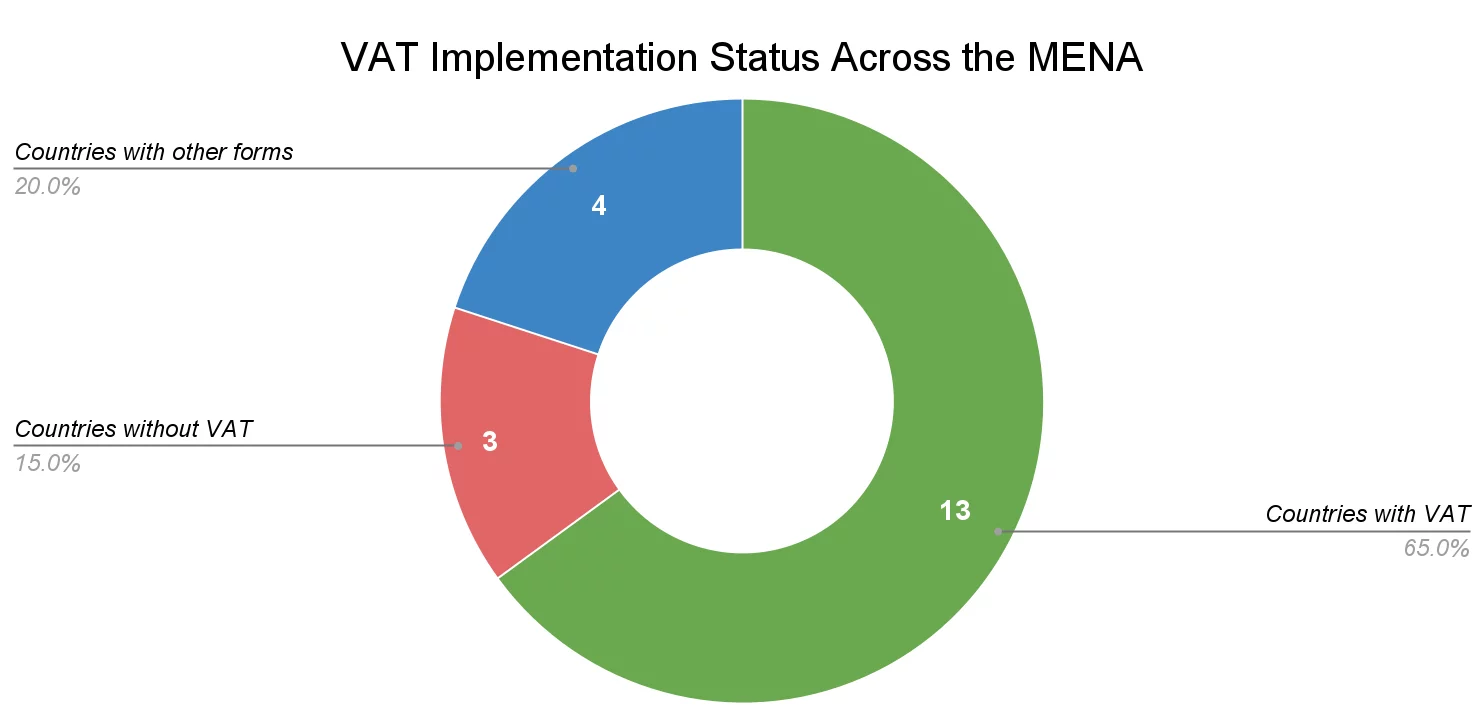

Out of 20 MENA countries included in the report, 13 have VAT systems in place, and three do not have VAT nor any other similar taxes in effect. In contrast, four have some form of indirect or consumption tax applicable to the supplies of goods and services.

While it is apparent from the data provided that unification and harmonization of the VAT system in the region is hardly achievable at this point, there is some progress in that area.

For example, Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates have concluded the Common VAT Agreement of the States of the Gulf Cooperation Council, commonly referred to as the GCC VAT Framework Agreement or the GCC VAT Agreement. The primary objective of the GCC VAT Agreement is to establish a unified and harmonized VAT system that enhances economic integration and promotes fiscal stability, while taking into account the diverse national economic goals, needs, and budgetary policies of the member states.

Although the implementation deadline was set for January 1, 2018, only two countries, the United Arab Emirates and Saudi Arabia, introduced VTA rules and regulations within the specified timeframe. Bahrain and Oman followed with the introduction of VAT in 2019 and 2021, respectively, leaving Qatar and Kuwait as the two GCC countries that have not adopted and enacted national VAT rules and regulations.

Defined standard VAT rates are additional issues that arise from the implementation of the GCC VAT Agreement. While the GCC VAT Agreement stipulates that all countries will apply a 5% VAT rate, Bahrain raised its VAT rate to 10% in 2022, and Saudi Arabia increased the applicable VAT rate to 15% in 2020, further contributing to the disharmonization of VAT rules across GCC countries.

This is a simple illustration of the challenges facing countries in the GCC region, which can be transferred to the MENA region, in achieving a more harmonized VAT environment, especially if the goal is to establish a system similar to that of the EU.

National VAT Frameworks in the MENA Region

Algeria

Algeria introduced Taxe sur la Valeur Ajoutée (TVA), also known as VAT, in 1992. VAT applies to both domestic transactions and import operations, such as sales, construction work, and services of an industrial, commercial, or artisanal nature, whether performed regularly or occasionally. A taxable person is any individual or business engaged in taxable activities, such as producers, wholesalers, subsidiaries, and certain professionals, regardless of whether the transactions result in VAT being charged or are exempt.

There are two applicable VAT rates: a standard VAT rate of 19% and a reduced VAT rate of 9%. The standard VAT rate applies to all supplies of goods and services, unless the Code of Taxes on Turnover explicitly defines the application of a reduced VAT rate or allows tax exemption.

For example, a 9% reduced VAT rate applies to sales transactions involving the distribution of electricity and natural gas for a consumption of less than 250 kilowatt hours (KWH) and 2,500 thermal units per quarter, heavy fuel oil, butane, propane, and their mixture consumed in the form of liquefied petroleum gas (GPL-C), services related to tourist activities, hotel, spa, classified tourist catering, travel and rental of tourist transport vehicles, and others.

VAT-exempt transactions include those carried out by a startup if the company meets the criteria to qualify as such. Additionally, construction activities and goods and services linked to the exploration, exploitation, and transportation, including liquefaction and pipelines, of liquid and gaseous hydrocarbons, are VAT-exempt.

Furthermore, banks and financial institutions benefit from VAT exemption on acquisition operations related to leasing. Sales of pharmaceutical products listed in the national drug nomenclature, export of goods and services, and internet access royalties are also exempt.

Bahrain

Bahrain introduced VAT on January 1, 2019, at a standard rate of 5%, thus becoming the third country from the Gulf Cooperation Council (GCC) trading block to enact national VAT rules and regulations. However, due to persistent fiscal pressures, the government doubled the rate to 10%, effective January 1, 2022.

The Bahrain VAT system requires that all taxable persons conducting an economic activity independently generate income and make annual supplies exceeding the mandatory threshold of BHD 37,500 (approximately USD 99,500) to register for VAT purposes, obtain a VAT registration certificate and a dedicated VAT account number, thereby enabling them to start collecting and remitting VAT.

In Bahrain, VAT applies to several types of transactions, including the supply of goods and services carried out within the country by a taxable person, the reception of goods or services from a supplier who is not established in Bahrain, and the importation of goods from outside the GCC implementing states.

The standard 10% VAT rate applies to all supplies of goods and services, except for those that are subject to a zero-rate or are exempt from VAT. Transactions or supplies subject to a zero VAT rate are an export of goods to outside the GCC implementing states' territory, supply of services from a resident taxable person in Bahrain to a customer residing outside the GCC implementing states, transportation services of passengers and goods to or from Bahrain, construction of new buildings, and many others.

Transactions and supplies, such as the supply of specific financial services, unless payment is made through explicit fees, commissions, or commercial discounts, and the sale, lease, or licensing of bare land and buildings, both residential and commercial, are exempt from VAT. Additionally, certain imports, including goods intended for diplomatic or military use that are exempt from customs duties, as well as personal effects and household appliances brought in by Bahraini citizens returning from abroad or by foreigners relocating to Bahrain for the first time, are exempt from VAT.

Djibouti

Before the introduction of the VAT, Djibouti’s tax system was based on separate codes that dealt with direct and indirect taxation. However, in 2009, Djibouti consolidated these different codes into a single document, known as the General Tax Code (GTC). Taxable persons subject to VAT rules and regulations include individuals and businesses that independently carry on taxable transactions, such as purchasing goods for resale, engaging in industrial, commercial, or handicraft-making activities, and providing services.

The GTC defines two applicable VAT rates: a standard VAT rate of 10% and a zero-rate VAT. Generally, a 10% VAT rate applies to all taxable transactions, except for those strictly subject to 0% VAT rate or VAT-exempt. The zero VAT rate applies to exports, services directly related to exports, as well as services related to the transit on the national territory of goods destined abroad, such as transport, services incidental to transport, services of customs agents, loading and unloading of means of transport, guarding, storage, and packaging of exported goods.

Additionally, international passenger transport, and payments received by companies holding a public contract with external financing concluded for an amount excluding tax, are also taxed at 0% rate.

Regarding VAT-exempt transactions, sales made directly to consumers by farmers, livestock breeders, or fishermen of unprocessed products of their cultivation, livestock breeding, or fishing are exempt. Furthermore, in Djibouti, certain operations are exempt from VAT due to their specific nature. These include banking operations, as well as insurance and reinsurance services provided by insurance companies in the normal course of business. The transfer of real estate and registered intangible personal property is exempt, except when carried out by property dealers or in the case of leasing operations. However, the sale of a building by the construction company that built it is not exempt and remains subject to VAT.

Egypt

The VAT system was introduced in Egypt in 2016, subjecting all taxable goods and services to VAT, unless they are explicitly exempted. While goods are broadly defined as any tangible item, regardless of its nature, origin, or intended use, and this includes electrical energy, services are described in negative terms: they encompass everything that does not qualify as a tangible good or item.

Any individual or business whose gross sales exceed EGP 500,000 (approximately USD 10.300) must register with the Tax Authority within 30 days of surpassing that threshold. However, this threshold does not apply to companies involved in importing or exporting goods, those providing services subject to schedule tax, or distribution agents, who must register regardless of the sales volume.

Notably, individuals or entities whose business activities are limited exclusively to goods and services that are exempt from VAT, traders dealing only in goods and services subject solely to the schedule tax, and individuals who are not engaged in the sale of goods or provision of services, even if their income exceeds the threshold are not required to register for VAT regardless if they exceed the threshold.

Taxable supplies are taxed at the standard VAT rate of 14%, reduced VAT rate of 5%, or zero VAT rate. While standard VAT applies broadly to all goods and services, reduced and zero VAT rates apply only to specifically listed transactions and supplies. For example, the 5% reduced VAT rate applies to the sale of machines and equipment, provided specific criteria and conditions are fulfilled. In contrast, 0% VAT rate applies to exported goods and services.

Regarding VAT exemptions, the VAT law exempts several basic goods and services that primarily affect low-income earners, including tea, sugar, coffee, banking services, medicines, healthcare services, and the sale and rental of land, as well as residential and commercial buildings.

Iran

The Value Added Tax (VAT) Law was ratified by the Iranian Parliament in 2007, and set a standard VAT rate at 1.5%. The initial wording of the VAT Law stipulated that the VAT rate would be annually increased from 1% to 8% by the end of the 5th Development Plan.

Consequently, the VAT rate has been adjusted under the Annual Budget Laws to the current 9%. Additionally, there are two higher special VAT rates for cigarettes and tobacco products, as well as gasoline and aircraft fuels, set at 12% and 20%, respectively. There is no VAT registration threshold. Therefore, all individuals and businesses engaged in taxable activities must register for VAT.

Article 12 of the VAT Law outlines a comprehensive list of goods and services that are exempt from value-added tax in Iran. The exemptions primarily focus on essential items and services that support basic living standards, public welfare, and national interests, including processed agricultural products, live animals, aquatic products, and basic food staples such as bread, rice, milk, and meat. Additionally, educational and cultural materials such as books, notebooks, and printing paper, as well as medical goods and services for both humans and animals, are excluded from tax to promote health and literacy.

Iraq

Iraq is one of the MENA countries that does not have VAT rules and regulations in effect. Instead, since 2015, a sales tax has been imposed on mobile services, the internet, the purchase of cars, tickets, cigars, and alcoholic beverages.

A 300% sales tax rate is imposed on alcohol, cigarettes, and tobacco products. Additionally, a 15% sales tax applies to travel tickets and car purchases, and a 20% tax applies to mobile recharge cards and internet services. Furthermore, a 5% sales tax rate applies to accommodation services provided by 5-star restaurants and hotels.

Israel

Value Added Tax (VAT) was introduced in Israel in 1976, and VAT currently applies to a broad range of transactions when carried out by a taxable person in the course of business. Transactions subject to VAT include the sale of assets, such as real estate, if located, delivered, or exported from Israel. In contrast, transactions entirely outside Israel fall outside the scope of the VAT law. Additionally, services and intangible goods sold or provided by businesses are also taxable, as are assets where input VAT has previously been deducted.

If taxable persons, either individuals or businesses, engage in selling assets or providing services as part of their business activities, excluding non-profit organizations and financial institutions that follow separate tax regimes, and have an annual turnover of NIS 120,000 (approximately USD 35,000) or more, they are required to register for VAT.

Once registered, businesses must apply the standard 18% VAT rate to most of their supplies. The standard VAT rate applies to all supplies of goods and services, except for those that are subject to a zero VAT rate. The zero VAT rate applies to transactions relating to the supply of medicines and certain financial and insurance services.

Jordan

Jordan implemented a sales tax, which consists of two types: a general sales tax (GST) and a special sales tax (SST). The GST is set at 16% and applies to sales of goods and services, as well as imports of any goods or services from outside Jordan or from the free zone areas and markets within Jordan. In addition to the standard GST rate, Jordan's sales tax system also has several reduced GST rates, set at 1%, 2%,4%, 5%, and 10%.

On the other hand, SST applies to strictly defined goods and only one type of service, such as beer, tobacco, and vehicles, and is applied as a percentage of a fixed amount.

Sales tax registration threshold varies depending on the supplies made by taxable persons. Therefore, those who import goods or services for trading must register with the Income and Sales Tax Department (ISTD) within 30 days of their first taxable import, regardless of the amount. However, suppose taxable persons are not engaged in importation activities. In that case, a JOD 75,000 (approximately USD 105,000) registration threshold is set for traders and manufacturers under GST, a JOD 30,000 (approximately USD 42,000) threshold for service providers, and a JOD 10,000 (approximately USD 14,000) registration threshold for manufacturers dealing in goods subject to SST.

In a situation in which taxable persons are engaged in multiple types of taxable activities, the relevant registration threshold is determined by the applicable category. If taxable persons are engaged only in zero-rated or exempt sales, they are not required to register for sales tax.

Regarding the exempt supplies of goods and services, they include the supply of wheat, bread, electrical energy, firefighting vehicles, education and training, and medical services.

Kuwait

Although Kuwait signed and ratified the GCC VAT Agreement, it has not yet implemented VAT. The initial plan to implement VAT in 2021 was delayed due to the negative economic impact of COVID-19 and subsequently inflationary pressures. Plans to continue implementing national VAT rules and regulations have changed in recent years. The latest information from the Kuwaiti government is that it plans a four-year rollout, which is expected to be completed by 2028. Nevertheless, there is still no official confirmation on any implementation timeline.

Lebanon

Lebanon introduced VAT in 2002, which applies to the supply of goods or services made in Lebanon by a taxable person, the importation of services by a Lebanese resident, and the importation of goods into Lebanon, regardless of the importer's status. In other words, VAT applies to all supplies, unless they are specifically exempt from taxation. The list of exempt supplies includes those related to postal services and stamps, education, insurance, financial services, the transfer of real estate, as well as books, newspapers, and magazines, among others.

Taxable persons who are engaged in taxable activities, and whose turnover is above LBP 5 billion (approximately USD 55,700) in any period varying from one to four consecutive quarters, must register for VAT within two months following the last day of the quarter in which the obligation to register arose. However, taxable persons who are engaged in the importation and exportation of goods or services that are zero-rated activities must register for VAT, regardless of their turnover.

VAT-registered taxable persons must apply the standard VAT rate of 11% to all their supplies, except for those subject to the zero VAT rate, which include exported goods and services, as well as international transport from and to Lebanon.

Libya

While around 175 countries worldwide have implemented a VAT system, Libya does not have one. Moreover, Libya abolished customs taxes in 2005, except for tobacco and tobacco products, as well as a 5% service fee on the value of most imports. Moreover, there have been no announcements from Libyan officials regarding the potential implementation and introduction of VAT or other types of consumption or indirect taxes in the near future.

Morocco

Morocco established a national VAT system, Taxe sur la Valeur Ajoutée (TVA), in 1986. VAT is charged on all supplies of goods and services carried out within the country, as well as on imports, including remotely delivered services by non-residents through digital means for Moroccan residents, except for those who are only temporarily in the country. Additionally, VAT applies to one-off supplies or imports of goods.

Individuals or businesses engaging in transactions subject to VAT, whether it involves the sale or importation of goods or services, even if it happens only once, are considered taxable persons. Since there is no VAT registration threshold, taxable persons must register for VAT at the same time they register for corporate or income tax purposes.

However, certain businesses are not required to register for VAT, but they may choose to do so voluntarily. The option to voluntarily register for VAT without mandatory registration is available to traders and service providers who directly export goods or services, manufacturers, service providers, and liberal professionals with an annual turnover of not more than MAD 500,000 (approximately USD 55,600). Additionally, traders selling unprocessed products and foodstuffs that are not exempt from VAT with deduction rights, as well as those renting out premises for professional use, fall into this category.

Regarding the applicable VAT rates, the 2024 Finance Act initiated a three-year reform to simplify VAT rates, with a gradual transition to 0%, 10%, and 20% VAT rates over the period from 2024 to 2026. However, until the transitional period is completed, transitional reduced VAT rates of 9%, 12%, 15%, and 18% also apply. These transitional rates are being adjusted upward or downward during 2025 and 2026 to align with target rates. The previously existing 7% and 14% VAT rates had already been removed.

The list of VAT-exempt transactions includes sales of goods such as fresh, frozen, whole, or cut fish products when they are not consumed on the spot, sales of recovered metals, and sales of water pumps powered by solar or other renewable energy sources for agricultural use. Additionally, services provided by taxable insurance and reinsurance entities, as well as royalties and license fees, are included in the taxable base for import VAT. School supplies, along with the products or materials used to make them, are also exempt from VAT.

Oman

VAT was introduced in Oman in April 2021 at a standard rate of 5%. The VAT applies to supplies of goods or services made by taxable persons, to goods and services received from non-resident suppliers not subject to Omani VAT, and to imports from outside the GCC implementing states.

The Oman VAT Law outlines provisions for mandatory and voluntary VAT registration thresholds, set at OMR 38,500 (approximately USD 100,000) and OMR 19,250 (approximately USD 50,000) over the past or upcoming 12 months, respectively. However, there are no revenue limits for VAT registration for non-resident companies, meaning they are subject to VAT as soon as they engage in taxable activities in Oman. In addition to this mandatory registration, foreign companies must also provide a bank guarantee or appoint an official registered representative with the Tax Authority.

The list of VAT-exempt supplies includes financial services, such as loans, advances, the issuance of shares and bonds, and life insurance, as well as healthcare and related services. Education services and associated goods are also exempt, along with the supply of undeveloped land, resale of residential property, local passenger transport, and the rental of real estate for residential purposes.

Palestine

Under the Paris Protocol, which is part of the Oslo Accords between Israel and the Palestine Liberation Organization (PLO), the Palestinian Authority was allowed to set the VAT rate, provided it was at least two percentage points lower than Israel's and applied uniformly across all goods and services.

However, under the Paris Protocol, all external trade between Palestine and third countries is governed by Israel, whose Tax Administration authority collects import VAT and other indirect taxes, and transfers them to the Palestinian Authority at a later stage, after deducting 3% to cover Israel's administrative costs.

Currently, Palestine's VAT rate is set at 16%. Any individual or company conducting business or providing services in Palestine, or earning income from abroad that originates from funds or deposits in Palestine, must register with the Ministry of Finance from the start of their activity or investment to avoid legal penalties.

The exemption from VAT is provided for small businesses with annual sales of less than USD 12,000. Businesses with more than one employee and annual sales between USD 12,000 and USD 50,000 are subject to a 16% VAT. However, they are exempt from the obligation to issue a VAT invoice. Finally, businesses with annual sales above USD 50,000 are liable for VAT and must issue VAT invoices.

Transactions exempt from VAT include those relating to investments in financial institutions, preschool education, research and development projects, transportation projects, infrastructure projects, and food processing projects.

Qatar

Qatar is another GCC country, besides Kuwait, that has not implemented national VAT rules and regulations, despite signing the GCC VAT Agreement. The Qatari government conducted consultations and trials, laying the groundwork for eventual implementation. Although VAT in Qatar is expected to mirror other GCC regimes, including a 5% rate, mandatory registration thresholds, and standard provisions of zero-rated and exempted goods and services, there is no established implementation timeline.

Saudi Arabia

Saudi Arabia implemented VAT at the standard rate of 5% on January 1, 2018. However, the Saudi Arabian government increased the standard VAT rate to 15% in July 2020 in response to the budget deficits during the COVID-19 pandemic. The VAT registration threshold is set at SAR 375,000 (around USD 100,000).

VAT applies to goods or services supplied within the country by a taxable person, when a taxable person acquires goods or services locally, when services are received under the reverse-charge mechanism, and when taxable imports are brought into the country.

Supplies exempt from VAT include certain financial and insurance services, provided that the payment is not made through explicit fees or charges. Additionally, real estate transactions are also exempt following the introduction of the Real Estate Transaction Tax (RETT) in October 2020, covering sales, leases, licenses, or rentals of property, except when they involve commercial property. However, supplies such as hotel accommodation, serviced accommodation, or residential property offered in a way similar to hotel services do not qualify for the exemption, and the lease of commercial property or property used for commercial purposes remains subject to VAT.

The Saudi Arabia VAT system has employed advanced compliance tools, including mandatory e-invoicing for B2B, B2C, and B2G transactions since 2020 for certain taxable persons, as well as strict audit mechanisms and penalties for non-compliance.

Syria

Syria is one of the countries that does not have VAT. Instead, the government implemented a Consumption Tax in 2015 on a variety of goods and services. Applicable tax rates range from one percent to 20%, but can reach up to 60% for automobile sales.

However, the Syrian Minister of Finance announced that the Tax Reform Committee continues to make significant and steady progress towards transforming the tax system. As part of these efforts, a preliminary draft of both the Income Tax Law and the Sales Tax Law has been prepared and submitted for public consultations. The Sales Tax has been defined as an indirect consumption tax on domestically manufactured and imported goods and services.

As announced, the upcoming tax system, scheduled to take effect at the beginning of 2026, is designed with a focus on simplification, transparency, and competitiveness, underpinned by partnership and trust with the private sector.

Tunisia

The VAT, also known as Taxe sur la Valeur Ajoutée (TVA) in Tunisia, was introduced in 1988 and is charged broadly on supplies of goods and services within the country, as well as on imports. Most business activities fall under the scope of VAT, but the production of agricultural and fish products is excluded.

Furthermore, professional services, wholesale trade, except for foodstuffs, and retail trade are also subject to VAT, provided the annual turnover of retailers reaches at least TND 100,000 (approximately USD 34,700). Nevertheless, key exemptions exist for foods, medicines, pharmaceuticals, and products that are subject to tariffs set by administrative approval.

Businesses and individuals that independently carry out taxable transactions, other than import sales, fall within the scope of VAT. However, an individual or company that supplies goods or services for consideration as part of their activities but is not obliged to register for VAT may still choose to do so under certain conditions. These conditions refer to conducting activities outside the VAT scope, engaging in export operations that are exempt from VAT, or providing VAT-exempt products or services to VAT-registered persons.

There are three types of VAT rates in Tunisia. The standard rate of VAT is 19%, and reduced VAT rates of 13% and 7% apply to specifically designated operations. As of January 1, 2025, the VAT rate on real estate transactions has increased from 13% to 19%, applicable to sales of residential property by real estate developers.

However, the 2025 Finance Act also introduces a reduction: sales of buildings constructed exclusively for residential use by real estate developers, where the tax-free sales price does not exceed TND 400,000 (approximately USD 139,000), will benefit from a reduced VAT rate of 7%. This measure replaces the previous 13% rate for real estate development with a two-tier approach, distinguishing between higher-value residential property, which is subject to the standard 19%, and more affordable housing, which is subject to the reduced 7% rate.

Other transactions subject to a 7% reduced VAT rate include transportation of goods, activities carried out by doctors and analytical laboratories, and tourism activities. In contrast, sales of low-voltage electricity intended for domestic consumption, as well as the sale of medium- and low-voltage electricity used for the operation of water pumping equipment for agricultural irrigation, are subject to a 13% reduced VAT rate.

United Arab Emirates

The United Arab Emirates (UAE), together with Saudi Arabia, was the first country in the Gulf region to implement VAT at the standard rate of 5% on January 1, 2018. Administered by the Federal Tax Authority, established in 2016, the UAE VAT Law includes familiar zero-rating and exemptions, as well as a mandatory VAT registration threshold of AED 375,000 (approximately USD 102,000) and a voluntary VAT registration threshold set at AED 187,500 (around USD 51,000).

VAT applies to the supply and deemed supply of goods and services made by a taxable person, the acquisition of goods from another GCC country by a taxable person, reverse-charge services received in the UAE, and the importation of goods into the country, regardless of whether the importer is a taxable person or not.

Financial services that are not provided in return for explicit fees, commissions, or similar charge, such as such as the issue or transfer of equity and debt securities, life insurance and related reinsurance, currency exchange, cheques and letters of credit, loans, advances, guarantees, account operations, derivatives, interest and dividend payments, investment fund management, and activities involving virtual assets like their transfer, conversion, custody, and management, are VAT-exempt.

Furthermore, the supply of residential buildings is exempt unless it is zero-rated, provided the lease term exceeds six months or the tenant holds an ID card issued by the Federal Authority for Identity and Citizenship. Additionally, the supply of bare land, meaning undeveloped land without buildings or civil works, is also exempt, as is the supply of local passenger transport services that qualify under the law.

Yemen

Yemen is another country without a VAT regime in place, which has decided to implement a different tax system. In 2001, Yemen introduced a General Sales Tax (GST), which, in its operational form, is similar to VAT. The standard GST rate applicable to most goods and services is 5%, whereas a special rate of 10% applies to mobile telecommunication services, and a rate of 90% is defined for cigarettes.

Furthermore, a zero rate applies to exports of goods and services and international transport, and transactions relating to the sale of children's milk. Yemen's officials set the GST registration threshold at an annual turnover of YER 50 million (approximately USD 208,000). Notably, non-established persons must appoint a tax representative or agent to carry out all the tax obligations on their behalf.

Key Harmonization Achievements and Gaps

Across the MENA region, the VAT systems show both elements of convergence and notable divergences. The GCC VAT Agreement demonstrates partial alignments, with the UAE, Saudi Arabia, Bahrain, and Oman adopting VAT.

National VAT systems among GCC countries have several structural features, including the concept of taxable persons, reverse-charge mechanisms for non-resident suppliers, and broadly comparable registration thresholds, typically around USD 100,000. Additionally, zero-rating of exports and international transport is a common thread in many countries, including Bahrain, Djibouti, Egypt, Israel, Morocco, and the UAE. At the same time, recurring exemptions for healthcare, medicines, basic food staples, certain financial services, and education reflect regional policy priorities, with Egypt, Iran, Lebanon, and Tunisia having these rules in place.

The digitalization of tax systems is another shared theme among MENA countries, with Egypt and Saudi Arabia implementing mandatory e-invoicing systems, and other jurisdictions, such as the UAE, Bahrain, and Israel, permitting or preparing similar measures. Administrative practices or requirements regarding the VAT return also converge, as the monthly and quarterly VAT return filings dominate across the region, ensuring regular reconciliation and refund opportunities.

However, significant differences persist. Standard VAT rates vary widely, from 5% in the UAE and Oman to 15% in Saudi Arabia, 18% in Israel, 19% in Algeria and Tunisia, and up to 20% in Morocco's reform pathway. In addition to this variety of applicable VAT rates, implementation remains uneven, with Kuwait and Qatar yet to introduce VAT. At the same time, Iraq, Libya, Syria, and Yemen continue to rely on broader consumption or sales taxes.

Furthermore, registration and compliance rules also lack uniformity. VAT registration threshold ranges from none in Iran and Morocco to specific monetary triggers in other countries. At the same time, non-resident requirements, such as the need for a local representative or bank guarantees, are applied inconsistently. Sector-specific rules and requirements further complicate the landscape. These primarily refer to sectors such as real estate, as illustrated by Tunisia’s planned real estate reclassification and Bahrain’s real estate exemption, as well as digital services.

In some instances, asymmetries in border administration highlight political and economic realities. Perhaps the most notable example is Palestine’s reliance on Israel for import VAT remittances and clearance under the Paris Protocol, a model not replicated elsewhere in the region.

Challenges of Regulatory Inconsistencies in Cross-border Trade

The coexistence of different VAT and non-VAT systems across the region creates significant frictions in cross-border trade.

For instance, an Algerian exporter subject to a 19% standard VAT rate may struggle when supplying goods to Bahrain, where the VAT rate is 10% and input recovery rules differ. In Algeria, the sale of electricity, natural gas, and fuels is subject to a reduced rate of 9%. In contrast, in Bahrain, energy-related supplies are not treated the same and may be subject to the standard VAT rate. This asymmetry in classification results in pricing complications and can undermine competitiveness, as Algerian suppliers face difficulties in aligning invoices with Bahraini import rules.

We can take the same two countries as an example of the difference in administrative procedures for VAT compliance. Algeria requires monthly electronic filing by the twentieth day of the following month, whereas Bahrain’s filing obligations vary from monthly to annual, depending on turnover, creating mismatches in filing frequency.

Furthermore, exporters attempting to align documentation often face delayed input recovery or mismatched VAT credits. For example, Djibouti's zero-rating of transport and logistics services may not be fully recognized under Egyptian rules, which impose VAT on specific service categories, thereby raising the risk of double taxation or denial of credits.

Since there is no common VAT system in the MENA region, non-resident businesses may face different obligations, further complicating cross-border trade. From mandating immediate VAT registration for non-residents and requiring a bank guarantee in Oman, to an ISL 120,000 VAT registration threshold for taxable persons in Israel with physical presence in the country, international businesses and those operating in the region must navigate inconsistent thresholds, exemptions, and representative requirements, which add administrative and financial burdens.

The result is a patchwork of overlapping but inconsistent frameworks that hinder the smooth functioning of intra-MENA supply chains. Instead of benefiting from harmonization, businesses often face compliance duplication, higher transaction costs, and a greater risk of disputes over input recovery, particularly in industries such as energy, logistics, and digital services that operate across multiple jurisdictions.

Practical Compliance Strategies for Businesses Operating in the MENA Region

To ensure alignment on compliance responsibilities, businesses operating in the MENA region should develop a “MENA-ready” indirect tax operating model and clearly communicate it to all key stakeholders. This operating model should include a regional tax control framework that reflects all local deviations in rates, exemptions, tax return filing frequency, registration requirements, and language-specific obligations for each jurisdiction.

Also, as part of this MENA-ready model, maintaining a centralized compliance calendar that captures return and payment deadlines, e-invoicing milestones, and certificate renewals, supported by automated reminders and evidence collection, may help businesses reduce the risk of missed obligations.

Another matter to consider as part of the strategy is having a clear understanding of the evidence requirements for each country, such as commercial invoices, transport documents, customs exit proofs, and contractual terms, tailored to meet each country’s specific rules, to ensure smooth audits and recoveries.

Master data governance should not be neglected at any cost, as it involves the proper recording of customer tax IDs, establishment status, Incoterms, and use-and-enjoyment flags, which ultimately prevent errors in place-of-supply determinations and rate applications.

Looking ahead, monitoring regulatory developments and preparing for evolving e-invoicing and digital audit requirements are critical for future readiness. Furthermore, adopting voluntary e-invoicing, as seen in the UAE, Bahrain, Israel, Morocco, Algeria, and Tunisia, strengthens internal controls and prepares companies for the eventual mandatory implementation.

Finally, due to a lack of harmonization and uniformity, non-resident businesses should map the rules and regulations applicable to them, and budget for associated compliance costs, thus ensuring that cross-border operations remain both efficient and fully compliant.