KSeF in Poland: What the National E-Invoicing System Means for Businesses and Law Firms (2026 Deadline Explained)

What Is KSeF and Why Was It Introduced?

Krajowy System e-Faktur (KSeF), or National E-invoicing System, is Poland’s centralized electronic invoicing platform developed to simplify the issuance, delivery, and storage of structured e-invoices. The implementation of this system was announced in 2023, with the initial plan to have all VAT-registered businesses use the KSeF system to issue and receive e-invoices by July 2024.

KSeF Implementation Timeline: 2024 Postponement and New 2026 Deadlines

However, the implementation was postponed, and the final date by which the first phase will be completed is February 1, 2026, when large taxable persons, meaning those with a turnover exceeding PLN 200 million (approximately EUR 47 million), will be required to issue and receive e-invoices for B2B transactions. Starting from April 1, 2026, all businesses, in addition to those mentioned above, will be required to comply with the e-invoicing rules and requirements.

The only exemption is provided for micro-businesses, those with total sales not exceeding PLN 10,000 (approximately EUR 2,350) per month during 2026, which will not be required to comply with e-invoicing rules until January 1, 2027.

Although there were some speculations that the implementation of the KSeF might be postponed once again, on March 31, 2025, the Polish Ministry of Finance released a response to a parliamentary inquiry confirming the implementation timeline.

KSeF Implementation Timeline:

February 1, 2026 | April 1, 2026 | January 1, 2027 |

|---|---|---|

Large Enterprises Deadline | All Businesses Deadline | Micro-Business Exemption |

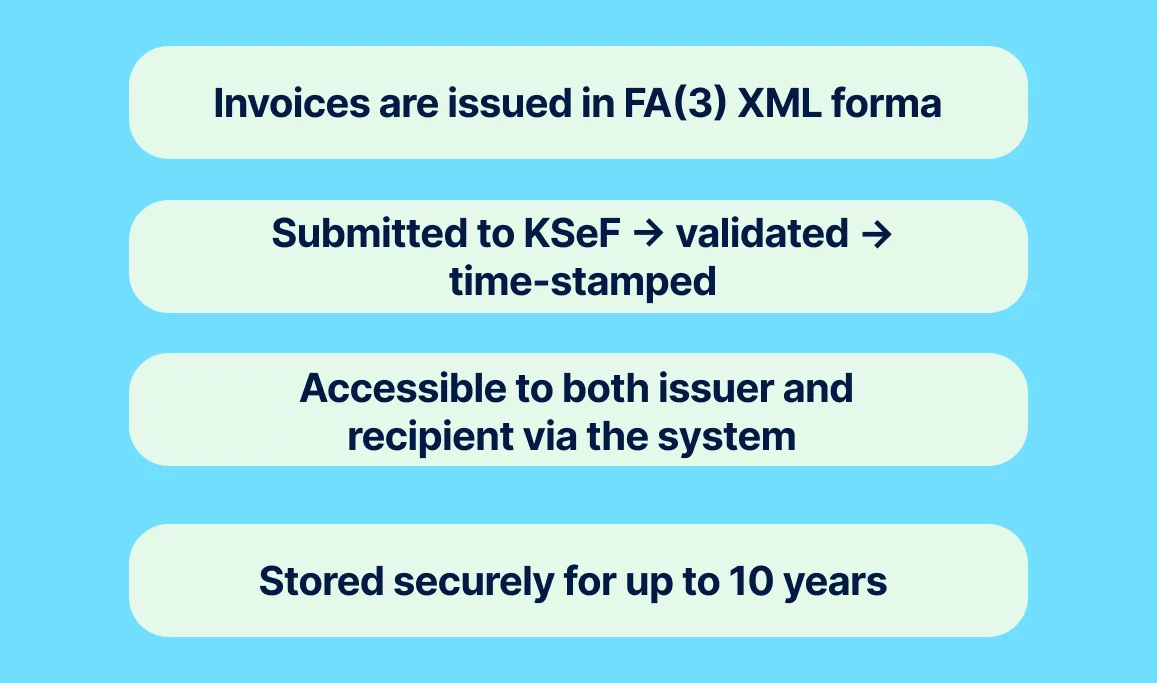

How KSeF Works: E-Invoice Submission, Validation, and Storage

The KSeF is developed in a way that, instead of companies sending invoices directly to their business partners, invoices are first submitted to KSeF, where they are validated and time-stamped. Once this procedure is completed, the invoice becomes available for both the issuer and the recipient through the system. All e-invoices will be stored in the system for a maximum of 10 years.

KSeF vs. EU VAT in the Digital Age (ViDA): Future Alignment Challenges

Considering that the KSeF is a national e-invoicing system, it is questionable how it will align with the EU's VAT in the Digital Age (ViDA) package. Under the ViDA package, which aims to standardize e-invoicing across the EU by requiring that invoices for cross-border intra-EU B2B transactions follow the EN 16931 format, the Polish government may need to upgrade KSeF to meet these requirements as well.

If the Ministry of Finance does not make the necessary adjustments once the mandatory EU B2B e-invoicing rules take effect, taxable persons may find themselves in a situation where they must use two separate systems: one for domestic transactions within KSeF and another for cross-border transactions under ViDA. This would ultimately create additional financial and administrative pressure.

Nevertheless, since the mandatory e-invoicing under ViDA is scheduled for July 2030, with the final date for harmonizing national e-invoicing systems with the EU standard and the intra-EU e-invoicing system set for January 1, 2035, it is to be expected that KSeF will be updated to meet all the requirements.

The Impact of KSeF on Law Firms in Poland

While the KSeF framework will impact all businesses in Poland, some industries face particularly complex adjustments. One of them is the legal sector. Law firms face a unique challenge: many still use legacy on-premise billing systems not designed for real-time data exchange or XML standards.

Karolina Šilingienė, Partner at Crespect (AI-powered legal practice management software), explains:

“We see many law firms still relying on systems built more than a decade ago. They were never meant to handle live data exchange, and adapting them to KSeF will be both costly and risky.”

As a result, firms may face difficulties ensuring seamless integration, data security, and timely compliance.

Crespect’s Perspective: How Legal Tech Can Ease the Transition

Based on Crespect’s experience in modernizing legal operations, Karolina Šilingienė emphasizes that the KSeF transition is not just a compliance challenge—it’s an opportunity for law firms to modernize and streamline operations.

At the same time, client expectations are rising. Law firm clients increasingly demand transparent, flexible billing, whether that means detailed time tracking, clear reporting, or predictable fee structures. If law firms rely on manual workarounds to meet KSeF obligations, they risk adding dministrative overhead that erodes profitability and distract lawyers from their core work.

“Clients are more demanding about billing transparency than ever. If compliance with KSeF creates extra manual work, firms risk losing valuable time that could otherwise be spent on clients,” adds Karolina.

To meet these challenges, cloud-native legal tech solutions like Crespect provide a future-proof alternative to outdated legacy system. Hosted securely on Amazon Web Services (AWS), Crespect is designed to scale seamlessly and adapt as KSeF and EU e-invoicing regulations evolve. Unlike older on-premise tools that require costly patches or replacements, cloud infrastructure enables fast compliance updates, ensuring firms stay compliant with minimal disruption.

Best Practices for Law Firms Preparing for KseF

From Crespect’s work with law firms modernizing their billing processes, a few best practices stand out:

Early Integration Planning: Evaluate how existing invoicing workflows align with KSeF’s structured e-invoicing requirements and identify gaps early.

Automation First: Manual compliance will not scale — automated invoice generation and secure API connections reduce risk and save billable hours.

Staff Training: Compliance isn’t just technical; fee earners and support staff need to understand new workflows to keep client experience smooth.

Technical Aspects: Formats, APIs, and Integration Options

The KSeF is developed to issue, receive, validate, and store structured e-invoices in the FA(3) XML format. Additionally, the Polish Ministry of Finance decided to use the Peppol Business Interoperability Specification (BIS) Billing 3.0 for e-invoicing.

The BIS Billing standard ensures that e-invoices are consistent, machine-readable, and can be easily exchanged between different systems. Furthermore, the Polish government developed the implementation guide Peppol Core Invoice Usage Specifications (CIUS) BIS Billing 3.0, tailored to include domestic business terms and address local tax requirements, particularly for corrected invoices.

For integration with existing systems, such as ERP, the Ministry of Finance publishes API documentation. A dedicated test environment will become available on September 30, 2025, giving businesses time to adapt their systems. The API is provided in OpenAPI 3.0.4 (JSON) format, accompanied by interactive documentation that covers endpoints, parameters, schemas, response codes, and example calls. An integrator guide has also been published, outlining the key features of KSeF 2.0 and providing practical usage scenarios for developers.

Since the KSeF is a national e-invoicing system developer for VAT-registered businesses, foreign or non-resident businesses not subject to VAT in Poland are exempt from the B2B e-invoicing rules.[KŠ3]

Considering the scope and importance of implementing the KSeF system, the Ministry of Finance has decided to postpone penalties for non-compliance until the end of 2026, providing additional time for businesses to adjust their systems to meet their obligations properly. [KŠ4]

Crespect’s Recommendations for Businesses

For law firms preparing for KSeF, Karolina recommends a structured approach:

1. Conduct a gap analysis – Map current billing and invoicing processes against KSeF requirements to identify where legacy systems may fail.

2. Assess technology readiness – Determine whether existing legal practice management or billing systems can handle structured XML and live API exchange. If not, consider cloud-native alternatives.

3. Engage IT and compliance partners early – Waiting until the last minute often leads to costly workarounds or rushed implementations.

4. Prioritize security and reliability – Ensure that any integration partner (internal or external) adheres to high security standards, given the sensitivity of client and financial data.

5. Avoid common pitfalls – The most frequent mistakes are underestimating integration complexity, neglecting staff training, and assuming temporary government tools are enough for professional use.

“If firms treat KSeF only as a compliance box to tick, they’ll miss the bigger opportunity. With the right systems, this can become a real catalyst for efficiency and transparency,” emphasizes Karolina Šilingienė.

By approaching the KSeF transition proactively, law firms can turn a compliance mandate into an opportunity: streamlined processes, greater billing transparency, and a stronger digital foundation for future growth.

About Crespect

Crespect - Intelligent legal practice management system to grow law firms

Crespect is an AI-powered legal practice management system with built-in CRM designed to manage and grow legal businesses. A tool that makes daily tasks smooth, rapid and intuitive for all the law firm‘s users.

Crespect is based on the experience of one of the most innovative international business law firms, Sorainen.

With Crespect users can increase revenue per lawyer by up to 30%. According to Sorainen, the saved time, and systematic performance encouragements based on business intelligence help to handle daily activities with ease but also feel the pulse of your client relationships and have a clear view of team performance.

Mehr Nachrichten von Polen

Erhalten Sie Echtzeit-Updates und Entwicklungen aus aller Welt, damit Sie informiert und vorbereitet sind.

-5cc23ezxyf.webp)

-z1d60bldtg.webp)

-8noukwsmba.webp)

-wzw9mcf563.webp)

-wjpr96aq5g.webp)

.png)