Indonesia’s Withholding Income Tax Rules for Digital Platforms

Summary

Indonesia introduced a 0.5% withholding income tax on sellers' gross turnover from qualifying transactions made through online marketplaces and digital platforms, effective July 14, 2025.

Qualified platforms are appointed as withholding agents, responsible for collecting, remitting, and reporting this tax to the government on behalf of the sellers.

Small businesses are exempt if their annual turnover is up to IDR 500 million (nearly USD 30,000). Platforms are only subject to the rules if they exceed certain thresholds for gross transaction value (e.g., IDR 600 million annually) or user traffic.

🎧 Prefer to Listen?

Get the audio version of this article and stay informed without reading - perfect for multitasking or learning on the go.

Indonesia's economy has grown rapidly over the past decade, transforming consumer habits and creating vast opportunities for sellers and service providers alike. The annual growth of around 5% in previous years, which is projected to remain at the same level through 2026 and 2027, is only one piece of evidence for these claims. Notably, a large portion of this growth has been driven by consumer activity, with e-commerce as the main contributor, accounting for around USD 71 billion.

The expansion and growth of the digital economy created an urgent need to improve tax-compliance mechanisms to align with modern, platform‑based commerce. Therefore, in 2025, the Indonesian government introduced a withholding income tax requirement for transactions conducted through online marketplaces and digital platforms.

Introduction to Withholding Income Tax in Indonesia

On July 1, 2025, the Indonesian Ministry of Finance issued a regulation that took effect on July 14, establishing formal withholding obligations for digital platforms and certain online marketplaces operating in Indonesia.

Under the regulation, e-commerce platforms are appointed as withholding agents for income tax on transactions conducted through their systems. In addition to enforcing new rules and requirements, the change marked a departure from the previous self‑reporting model, in which individual sellers were solely responsible for filing and paying their own income taxes.

At its core, the Indonesian income tax withholding mechanism requires designated platforms to withhold 0.5% of sellers' gross turnover from qualifying transactions. The tax is calculated on the gross value of income received by sellers through the platform, excluding VAT and Luxury Goods Sales Tax (LGST). The withholding requirement is triggered when payment is made to the seller, and the platform is responsible for depositing the collected tax into the state treasury monthly.

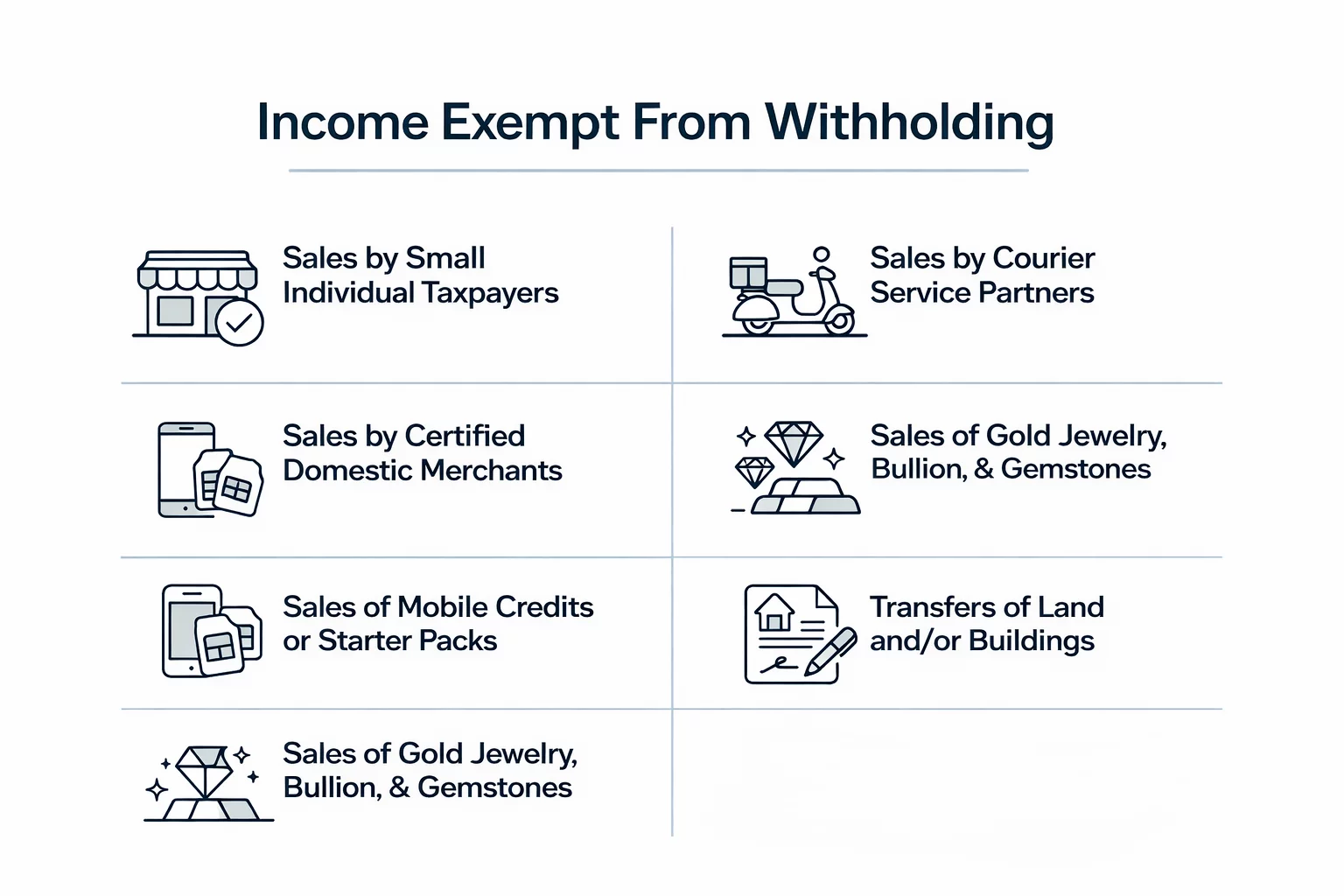

Before jumping to which e-commerce and digital platforms are liable for withholding income tax, it is necessary to clarify that certain transactions and sellers are excluded from this obligation. The exemptions apply to online app-based delivery services where drivers are treated as partners, to the sale of phone credit, and to specific categories such as gold jewelry and bullion.

Who Needs to Withhold Income Tax in Indonesia

To set one thing clear, not all e-commerce marketplaces and digital platforms come under the scope of the withholding requirements. To be considered as a qualified platform, it must meet certain criteria. These criteria refer to exceeding an annual gross transaction value threshold, demonstrating significant user traffic or transaction frequency within 12 months, and using an escrow or equivalent settlement mechanism to manage funds from buyers to sellers.

Regarding the transaction threshold, if the transaction value exceeds IDR 600 million (approximately USD 35,700) in 12 months, or IDR 50 million (approximately USD 3,000) per month, for transactions from Indonesian consumers, e-commerce or digital platforms must withhold and remit income tax. The same applies if the foreign or domestic platforms have more than 12,000 Indonesian users in 12 months or 1,000 users per month. Once platforms meet these criteria, they are designated as withholding agents or income tax collectors.

It is also important to note that not all sellers are subject to having their income tax withheld. To protect small businesses, the Indonesian government granted an exemption to sellers with an annual turnover of up to IDR 500 million (nearly USD 30,000).

Reporting and Other Obligations for Digital Platforms

Withholding and remitting 0.5% on each qualifying transaction does not end the obligations of the in-scope digital platforms. Additionally, withholding agents are subject to reporting and administrative obligations, such as submitting monthly tax returns that detail the sellers, transaction amounts, and amounts withheld as income tax.

Furthermore, platforms must issue documents, such as withholding certificates, tax invoices, or similar records, to sellers serving as proof of the tax withheld. Another critical reporting requirement is to provide the Tax Authority with sellers' information, such as Tax Identification Numbers (NPWP) or Resident Identification Numbers (NIK), as well as seller contact information. Notably, sellers are responsible for providing this data to platforms.

Impact on Domestic and Foreign Businesses

The reform of the Indonesian tax regime primarily impacts domestic online sellers and domestic and foreign online marketplaces and digital platforms. Although small sellers with IDR 500 million can qualify for exemption, they still engage with platforms to verify their status and maintain compliance documentation.

Those who exceed the threshold stand to benefit from simplified compliance when platforms manage withholding and reporting processes effectively. Nevertheless, they must be vigilant in accurately reporting their income, retaining records of withheld taxes, and reconciling withheld amounts with their tax filings at the end of the fiscal year.

For domestic and foreign digital platforms operating in Indonesia, new rules meant additional investments in tax compliance infrastructure. However, it also clarified reporting responsibilities, reducing the risk of future disputes with Tax Authorities. It is safe to assume that global platforms such as TikTok Shop, Tokopedia, Shopee, Lazada, Blibli, and Bukalapak are among the most affected by these rules.

Conclusion

The rationale for assigning withholding responsibility to platforms rather than sellers is based on compliance efficiency: platforms that process high transaction volumes are better positioned to collect and report taxes on behalf of many smaller sellers who might otherwise fail to comply with their tax obligations. Thus, while sellers are the ultimate taxable persons on the income they earn, the withholding system effectively shifts the administrative burden of collection and remittance to platforms.

Notably, even if platforms are not currently required to withhold income tax, that does not mean that they will be excluded from this obligation forever. Since the Directorate General of Taxes has the authority to assess platforms annually and designate new withholding agents based on updated transaction or usage data, it is essential to monitor each criterion and familiarize oneself with all related obligations.

Source: Indonesia Ministry of Finance - PMK 37 OF 2025, VATabout - New Tax Rules for Online Sellers in Indonesia, IMF - Indonesia’s Economy Maintains Resilience Amid Global Uncertainty, KPMG, PwC

More News from Indonesia

Get real-time updates and developments from around the world, keeping you informed and prepared.

-e9lcpxl5nq.webp)