Non-Resident Digital Services and VAT: Understanding Withholding Regimes

Summary

Withholding VAT is a tax collection mechanism in which the responsibility for withholding and remitting VAT on digital services by non-resident providers shifts from the supplier to a third party, such as a customer, a digital platform, or a financial intermediary.

This regime aims to ensure VAT is captured immediately, addressing the difficulty of enforcing traditional supplier-registration models when the supplier lacks a physical presence in the customer’s country.

The withholding VAT mechanism differs from the reverse-charge mechanism (which typically applies only to B2B transactions) and, despite reducing direct compliance, non-resident suppliers still have obligations, such as providing tax information and monitoring changing withholding rules.

🎧 Prefer to Listen?

Get the audio version of this article and stay informed without reading - perfect for multitasking or learning on the go.

The digital economy poses many challenges and complexities for governments worldwide, complicating their ability to correctly collect VAT on digital services supplied by providers who are not resident in the customer's country. Historically, VAT systems focused on supplier registration and direct collection, but digital commerce often involves suppliers with no physical presence, making it difficult for Tax Authorities to enforce collection.

With these issues at hand, governments took different approaches, with some countries implementing or refining withholding VAT regimes in which intermediaries, customers, or platforms are responsible for withholding and remitting VAT on behalf of non-resident digital service providers.

Withholding VAT as an Alternative to Registration-Based Models

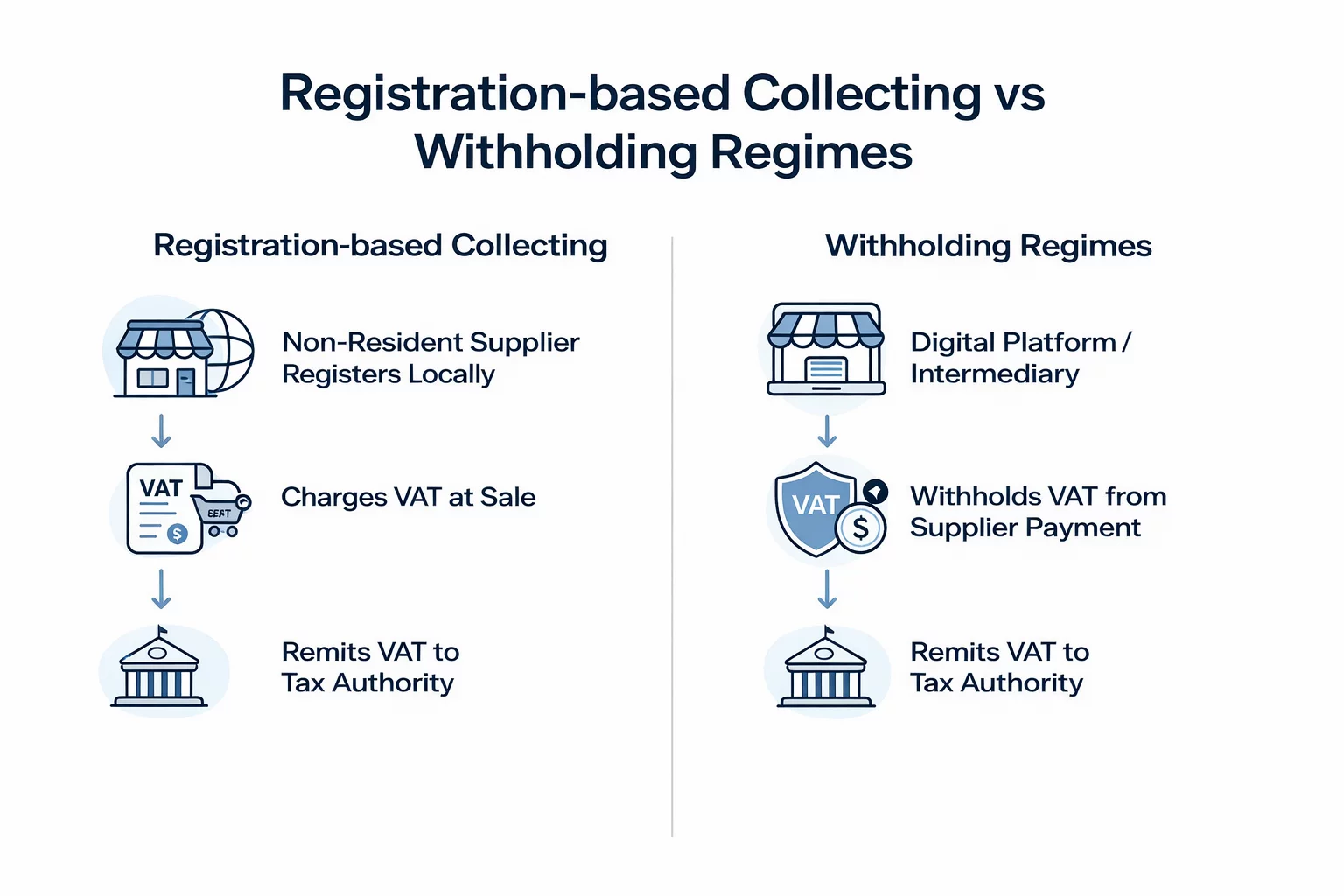

Under traditional VAT models, non-resident digital service providers are typically required to register for VAT in the customer’s jurisdiction, charge VAT at the point of sale, and remit it to the local authorities. Even though this model aligns with conventional VAT principles, the compliance burdens it imposes on small and remote digital businesses create enforcement gaps when providers do not register or cannot be easily compelled to do so.

In response to these issues, governments are adopting withholding mechanisms as alternatives or supplements to supplier registration. In contrast to the traditional VAT models, under the withholding VAT regimes, the responsibility for VAT collection shifts from the non-resident supplier to another party, often the digital platform, intermediary, or even the customer, who withholds VAT at the time of payment and remits it to the local Tax Authority.

Given how the withholding mechanism works, it ensures that VAT is captured immediately at the time of the transaction, without requiring the non-resident supplier to navigate complex local registration requirements. Moreover, in some instances, it effectively replaces supplier VAT registration, particularly when intermediaries are well-positioned to capture transaction data and enforce withholding.

Role of Customers, Platforms, and Financial Intermediaries

The withholding mechanisms are commonly referred to as customer-based VAT collection, meaning the customer is required to withhold the VAT due on a transaction and remit it directly to the Tax Authorities on behalf of the non-resident supplier. In a B2B transaction involving a fully taxable business, it may normally deduct the withheld VAT as input tax. On the other hand, for B2C transactions, the responsibility lies with other entities.

Over the past few years, as online sales and transactions have risen, the withholding mechanism has evolved significantly, with digital platforms and online marketplaces now serving as the primary withholding agents. Digital platforms and online marketplaces, as intermediaries, collect payments from end consumers or users, distribute proceeds to suppliers, and are well-positioned to calculate and withhold VAT at source.

For example, in Mexico, digital platforms must withhold 100% of the applicable VAT on sales when funds are paid to non-residents and must collect information from sellers regarding foreign bank accounts and obtain their consent to withholding.

Another group of entities responsible for withholding VAT are financial institutions, or more precisely, financial intermediaries and payment service providers, especially when they facilitate payments between customers and non-resident providers. One such example can be found in Argentina, where resident or local payment intermediaries are responsible for withholding VAT at the standard rate of 21% on B2C transactions made to foreign digital service providers.

Differentiating Reverse-charge and Withholding VAT Mechanisms

Before moving on, it is essential to note that, despite the withholding mechanism being similar to a reverse-charge mechanism, primarily because of their customer-based liability, the two differ. The reverse-charge mechanism is a VAT-specific mechanism that shifts the obligation to account for and pay VAT from the supplier to the buyer, typically in situations involving non-resident suppliers. Withholding mechanism, on the other hand, can apply to both direct and indirect taxes and may involve third parties such as banks or platforms.

Under the reverse-charge mechanism, the buyer is liable for the VAT due in its own jurisdiction on goods or services purchased from a non-resident supplier. As a result, the non-resident supplier does not need to register for VAT or otherwise comply with local VAT accounting obligations for that transaction. The reverse-charge mechanism applies only to B2B transactions and can be used for both domestic and cross-border supplies.

Compliance Obligations for Non-Resident Digital Suppliers

Although VAT liability lies with resident or local customers, platforms, or intermediaries, and withholding regimes reduce the direct compliance burdens on non-resident digital service providers and suppliers, foreign suppliers still face certain obligations in relation to the VAT withheld on their behalf. Therefore, digital service suppliers must understand the VAT rules and applicable rates in the customer’s country, at an early stage, often when prices are agreed, even though the taxable event may occur later.

Some of the most common responsibilities of the non-resident suppliers are to provide accurate tax identification or information to enable correct withholding. For example, non-resident suppliers must correctly determine when and where a digital service is deemed to be supplied and thus subject to withholding. Additionally, they must ensure their invoices are issued correctly and include all relevant data, such as the correct VAT rate and the total amount of VAT.

Notably, foreign digital service providers are frequently asked by local liable persons, commonly referred to as withholding agents, to provide additional data or documentation to substantiate the nature of the services provided and any applicable exemptions.

Conclusion

Even though they are not directly remitting VAT, non-resident service providers must monitor changes in withholding rules, as these can affect pricing, contractual terms with platforms, and customers’ VAT obligations. Non-compliance with these rules may primarily result in financial penalties and additional administrative work. Still, some countries may impose a temporary suspension of service access if withholding requirements are not met.

Source: OECD - Mechanisms for the Effective Collection of VAT/GST, VATabout - VAT on Digital Services in Argentina, OECD - Consumption Tax Trends 2024, VATabout - Mexico, HMRC - Alternative method of VAT collection, United Nations - Indirect taxation of e-commerce and digital trade, VATabout - A Simple Guide to Reverse Charge Mechanism

Featured Insights

Nigeria VAT Compliance: TaxPro Max Explained

🕝 March 3, 2026More News from World

Get real-time updates and developments from around the world, keeping you informed and prepared.

-e9lcpxl5nq.webp)

-7xdqdopxl6.webp)

-a9bz8kz2cs.webp)