AI in Tax Compliance: Understanding the Stack and Use Cases

Summary

AI as a Compliance Enabler: Businesses face rising complexity in VAT, GST, and e-invoicing, which AI (including machine learning and GenAI) is well-positioned to address by automating repetitive tasks, improving accuracy, and detecting irregularities, though its integration requires responsible risk management.

The Enhanced Tax Compliance Stack: The stack covers processes from data collection to audit readiness. AI integrates as a new layer in this stack, automating data ingestion, validation, classification, and risk scoring, while human experts retain responsibility for final oversight and interpretation.

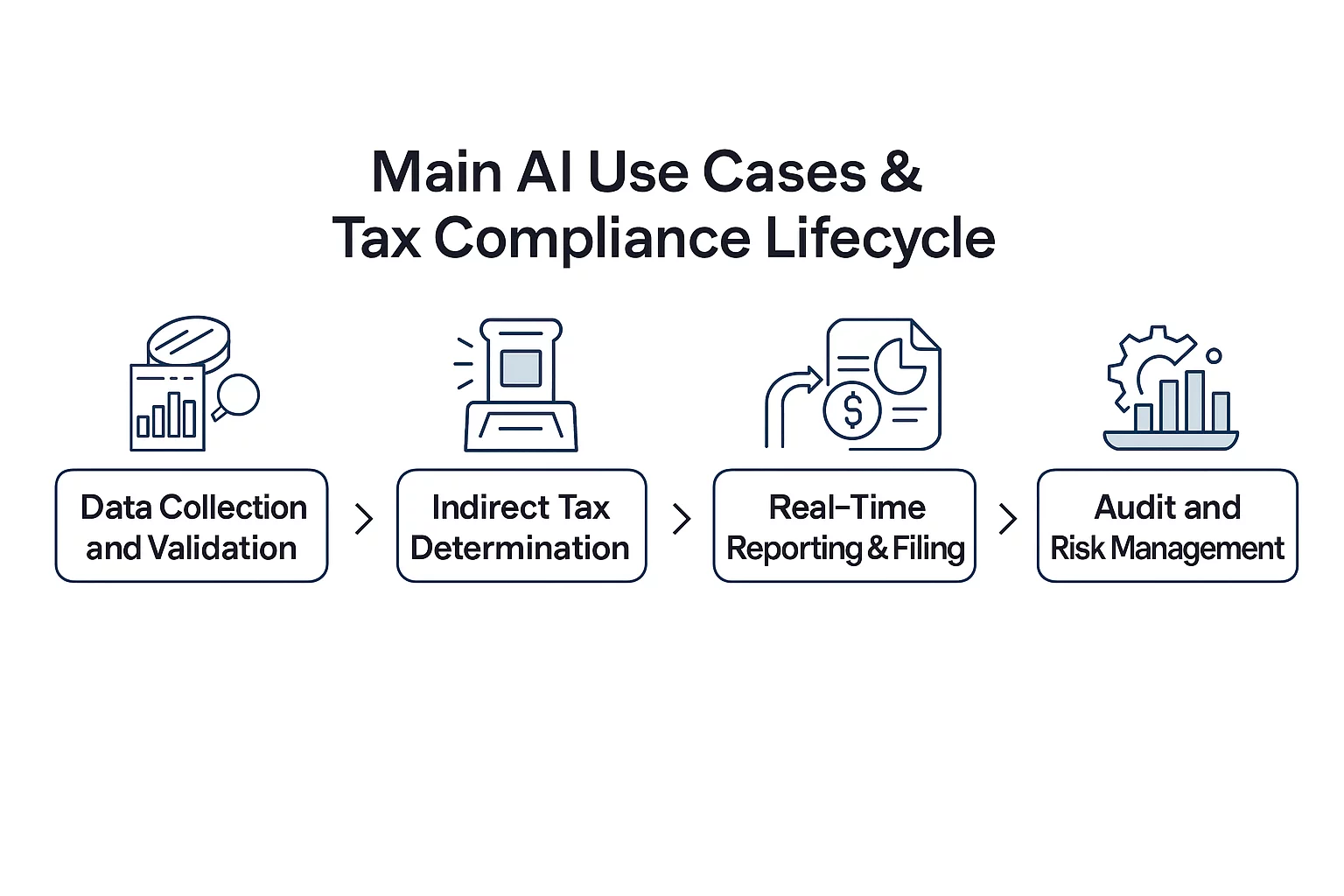

Core AI Use Cases: AI is applied across the compliance lifecycle to enhance efficiency, including automated data extraction and validation from diverse documents, prediction of correct indirect tax treatment for transactions, real-time reporting and filing, and transformation of audit preparedness through proactive risk detection and anomaly flagging.

🎧 Prefer to Listen?

Get the audio version of this article and stay informed without reading - perfect for multitasking or learning on the go.

Businesses, particularly international, deal with diverse VAT, GST, sales, and consumption tax regimes, e‑invoicing obligations, real-time reporting, and frequent changes in tax legislation. At the same time, technological advances unlocked new opportunities to simplify, streamline, and fortify compliance.

Even though technology is constantly evolving and, in practice, should contribute to more straightforward and precise tax compliance, ongoing regulatory changes increase complexity and data volumes, creating an even more challenging environment for taxable persons. Notably, among all technologies, AI stands out as a potentially transformative enabler.

With its many forms, including machine learning, natural language processing (NLP), and generative AI (GenAI), AI promises to automate repetitive tasks, improve accuracy, detect irregularities, and reduce the burden on in-house tax or accounting teams. Nonetheless, using AI for tax compliance is not without its risks and pitfalls.

Thus, the key question is not whether to use AI, but how to integrate it responsibly, ensuring that the benefits outweigh the risks. However, before going deeper into how businesses can benefit from AI and how to implement it as part of their tax compliance strategy, it is necessary to clarify what the tax compliance stack refers to and the typical use cases of AI in tax compliance.

Understanding the Tax Compliance Stack

At its core, the stack comprises multiple layers and processes, from gathering and validating transactional data to applying VAT or GST rules, preparing and filing returns, and ultimately monitoring compliance and audit readiness.

In a non-AI setup, commonly referred to as traditional setups, most of these tasks are human-dependent. Although traditional setups have already been significantly affected by automation and technology, they still rely heavily on human effort. For example, in most setups, accountants still manually collect invoices and receipts, cross-check data, assign correct tax codes, calculate tax liabilities, fill in tax forms, and track deadlines.

Businesses operating in multiple jurisdictions and markets may find this approach particularly ineffective, as manual processes quickly become laborious, error‑prone, and resource-intensive. Therefore, adding AI as an additional layer to the stack creates a new architecture in which data ingestion, validation, classification, and even risk‑scoring are at least partially automated. At the same time, human experts remain responsible for oversight, interpretation, and final decisions.

AI Use Cases Across the Tax Compliance Lifecycle

The AI can be applied at different stages of tax compliance, from data collection and validation to indirect tax determination and real-time reporting and filing, to audit and risk management. Essentially, the AI can integrate into the compliance stack, enhancing and automating parts of the process that were previously manual, slow, or error-prone.

Data Collection and Validation

One of the most essential yet slow and error-prone parts of tax compliance is data collection, which includes invoices, receipts, bank statements, expense reports, ledger entries, and more. As if the shared volume of required data is not enough, these data sources often come in different formats, such as PDF invoices, scanned receipts, spreadsheets, and free‑text descriptions.

Extracting and validating all of the relevant information, like dates, amounts, tax rates, and entity names, manually consistently across all these sources, is a heavy administrative burden. This is where AI comes in. The AI enables automated extraction of structured data from unstructured or semi-structured documents and can filter for vendor names, invoice numbers, line‑item details, and tax rates, even when formatting differs across documents.

Once the key data is extracted, a machine-learning algorithm can cross-check all entries, including verifying that amounts on invoices match ledger entries and comparing suppliers' tax identification numbers with the known vendor list. Some more advanced systems may even validate document authenticity, flagging possible duplicates, discrepancies, or suspicious formatting. Ultimately, the AI becomes a first-level filter, enabling humans to focus only on exceptions or flagged items.

Indirect Tax Determination

In addition to helping with the collection and validation step of the process, the AI can also assist with the next step in many tax stacks: assigning the correct tax treatment to each transaction. This step of the process includes determining which tax rate applies, whether a transaction is exempt or zero-rated, whether reverse charge rules apply, and so on. Completing this task is particularly complex for multinational or cross-border operations.

An AI-based model can use historical data to learn to predict what tax treatment a new transaction likely requires. Based on past patterns, vendor classification, type of goods or services, trading partners' locations, and other vital data, AI can suggest a likely tax code, flag ambiguous cases, or raise alerts when the predicted classification differs from usual patterns.

Real-Time Reporting and Filing

As real-time reporting and more than periodic filing, such as e‑invoicing mandates, SAF-T, CTC, or e-reporting, become increasingly prevalent in modern tax systems, businesses face greater pressure to meet standards and requirements. Since the AI can be trained to automatically map data from accounting logs or ERP to statutory reporting formats, it can facilitate these obligations.

For example, once the transaction data is collected and properly classified, AI can aggregate and validate it, then automatically populate tax return templates or e-reporting files. Moreover, with predefined rule logic, AI can check compliance with local formats, applicable VAT or GST rates, reporting deadlines, and identify missing or inconsistent data before submission.

Audit and Risk Management

AI can transform audit and risk management from reactive, meaning when the issues occur, to proactive, meaning ensuring businesses are audit-ready. More specifically, by enabling the processing of massive datasets, the identification of patterns, and the highlighting of anomalies, the AI can monitor compliance and detect risks.

As more and more Tax Authorities use AI to conduct more targeted and efficient audits, businesses can use AI-based models to flag unusual patterns in business-wide transaction data, such as sudden spikes in expenses, mismatched invoice‑payment pairs, suspicious vendor address changes, and duplicate invoices.

Since the Tax Authorities may view these issues as an attempt to evade taxes or commit tax fraud, with its detection, predictive analytics, and risk scoring capabilities, AI can significantly enhance the capacity to notice and address these issues on time.

Coming Up: Benefits, Risks, and Implementation of AI

While this article focused on the connection between tax compliance and AI, the following article, AI in Tax Compliance: Benefits, Risks and Smart Integration, provides further insights into how AI can transform tax compliance beyond day-to-day operations. More specifically, the next article will dive into practical strategies for implementing AI responsibly, balancing human oversight with automation, and ensuring businesses reap the benefits while managing the risks effectively.

Source: OECD - Governing with Artificial Intelligence, Bloomberg, VATabout - How to Build an Indirect Tax Control Framework, IMF, PwC, VATabout - Digital Transformation & VAT Compliance: Strategies for Success in the Digital Age

Featured Insights

Nigeria VAT Compliance: TaxPro Max Explained

🕝 March 3, 2026More News from World

Get real-time updates and developments from around the world, keeping you informed and prepared.

-e9lcpxl5nq.webp)

-7xdqdopxl6.webp)

-a9bz8kz2cs.webp)