US Tariffs on EU Goods Explained: The 2025 EU-US Trade Deal

Summary

Heightened US-EU trade tensions in 2025 began with the Trump administration's decision to impose broad tariffs on imports, culminating in the political framework agreement announced on July 27, 2025.

The agreement established a single, all-inclusive US tariff ceiling of 15% on the majority of EU goods, effective from August 1, 2025, which replaced the previous system of stacked and retaliatory tariffs.

The 15% tariff ceiling makes European products more expensive in the US, particularly in sectors like automotive, pharmaceuticals, and technology, forcing EU exporters to decide whether to absorb the costs or pass them on to US consumers.

🎧 Prefer to Listen?

Get the audio version of this article and stay informed without reading - perfect for multitasking or learning on the go.

When it comes to international trade, the word of 2025 was tariffs. The US decision to impose tariffs on imports from countries around the globe also dominated trade relations between the US and the EU. US-imposed tariffs evolved into a negotiated framework between Washington and Brussels, setting a new tariff regime and trading relationship.

Even though many economists, analysts, and EU officials, including the German Chancellor Friedrich Merz and the French Prime Minister François Bayrou, have described the US-EU trade deal as bad for the EU, European businesses exporting goods and services to the US must still understand the agreement's dynamics and its impact on their operations.

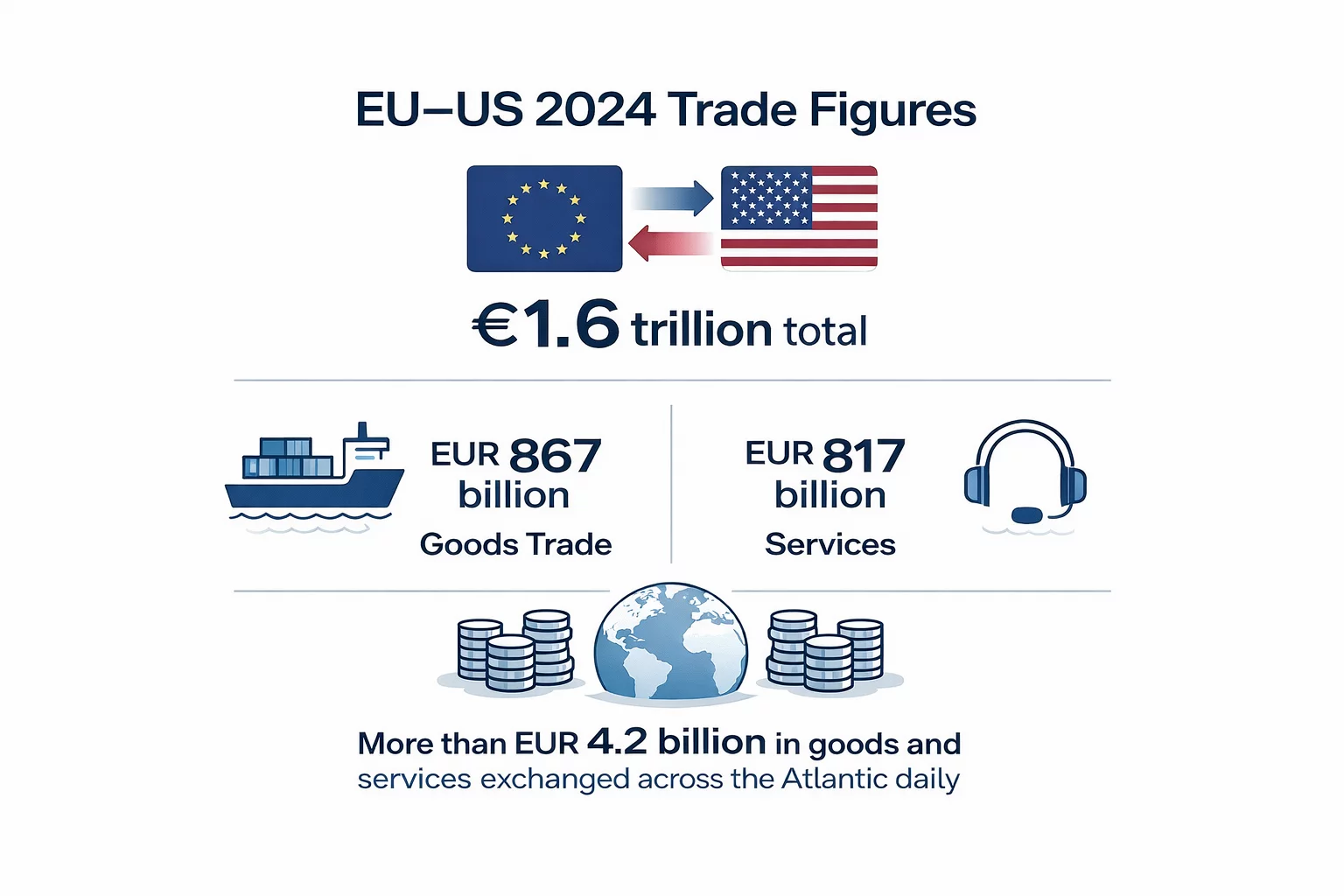

Note: Data in the image is from the European Council - EU-US trade: facts and figures

Overview of US Tariff Measures Affecting the EU

The US has a long-lasting history of using tariffs as a trade policy tool. Nonetheless, tariffs escalated in April 2025, when the Trump administration announced a comprehensive set of tariff increases affecting imports from nearly all trading partners, including the EU.

The implemented measures established a universal baseline tariff of 10% on all imported goods and imposed additional country-specific duties based on bilateral trade imbalances. In the case of EU exports, this meant exports to the US became subject to a substantially higher burden, with a 20% tariff applied to most EU products from April 9, 2025. Just weeks earlier, on March 12, 2025, the US had already reinstated 25% tariffs on steel and aluminium imports, reviving measures that particularly affected key EU industrial sectors.

Taken together, the baseline tariffs, the EU-specific tariffs, and the new sector-specific duties represented a sharp tightening of access to the US market for European exporters. Nonetheless, shortly after announcing these tariffs, the Trump administration announced a 90-day pause on the full implementation of the new tariffs for most trading partners. As a result, the tariff rate on EU goods was reduced from 20% to the baseline 10%, while the 25% duties on steel, aluminium, and automobiles remained unchanged.

In response to the US tariffs, the EU announced countermeasures targeting US steel and aluminium tariffs and also suspended them for 90 days, creating room for dialogue and an EU-US agreement. However, the situation further escalated in June and July 2025, when the US sharply increased tariffs on steel and aluminium from 25% to 50%, and announced a new round of tariffs, imposing a 30% duty on EU goods to take effect on August 1, 2025, respectively.

Despite the dynamic events during this period and the ongoing US pressure on the EU, the EU and the US continued negotiations, culminating in a political framework agreement announced on July 27, 2025, which marked a significant step toward easing tensions and reestablishing economic cooperation.

The US - EU Trade Deal Explained

At its core, the trade deal establishes a single, all-inclusive US tariff ceiling of 15% on EU goods, effective from August 1, 2025. The ceiling tariff applies to the vast majority of EU exports, including nearly all EU exports subject to reciprocal tariffs, cars and car parts, and specified pharmaceuticals and semiconductors. Additionally, the 15% tariff replaced the previous system of stacked tariffs by setting a clear maximum rate, including the US most favoured nation (MFN) tariff.

Furthermore, under the trade deal, the US tariffs on EU aircraft and aircraft parts, certain chemicals, selected generic medicines, and natural resources reverted to their pre-January levels, easing pressure on key EU industries. Both parties acknowledged that they will work together to protect their steel, aluminium, and copper sectors by establishing tariff rate quotas for EU exports at historic levels.

One of the key elements of the agreement is the liberalisation of trade flows from the US into the EU, with mutual benefits identified. As noted, these measures should save EU importers and consumers nearly EUR 5 billion annually in duties, while safeguards remain in place to protect sensitive EU industrial and agricultural sectors.

In addition to the market-opening measures, the EU-US trade agreement places strong emphasis on reducing non-tariff barriers in targeted areas, such as fisheries products and agriculture. This includes enhancing cooperation on automotive standards, sanitary and phytosanitary measures, and expanding mutual recognition of conformity assessments across additional industrial sectors.

Furthemore, both the EU and the US committed to strengthening cooperation on economic security, including supply chain resilience, addressing non-market policies, and coordinating more closely on investment screening and export controls.

Note: Data in the image is from the European Council - EU-US trade: facts and figures

Impact on EU Exporters and Supply Chains

Essentially, the 15% tariff ceiling on most goods entering the US from the EU makes European products more expensive in the US, hurting competitiveness in cars, pharmaceuticals, and tech components. One of the key considerations for EU companies is whether to absorb part of the tariff burden to defend their market share in the US. However, in doing so, the EU exporters would also squeeze margins. The other solution is to pass the costs on to US consumers, which could dampen demand and ultimately reduce trade volumes.

In September 2025, Eurostat released a report showing that the EU trade surplus with the US rose to EUR 19.4 billion, up EUR 1.9 billion from August and well above the EUR 12.9 billion recorded in September 2024. Overall, EU exports to the US increased to EUR 53.1 billion in September, a 15.4%year-on-year rise. The main driver of these results was exports from the EU chemical sector.

The impact of the trade deal can also be seen through the example of EU agri-food exports. While the EU agri-food exports overall rose by 2% in value during the first ten months of 2025 compared with the same period in 2024, exports to the US fell by 3% over the same period. Regarding the impact on prices in the agri-food sector, prices for cocoa paste, butter, and powder rose by 68%, while coffee prices increased by 29%.

It is necessary to note that the decline cannot be attributed solely to trade policy or the recent tariffs, and that the USD-EUR exchange rate effects also played a critical role in the result.

The supply chain is also adjusting to the hybrid landscape, in which specific inputs may face divergent tariff treatments. For example, semiconductors and pharmaceutical products are subject to the agreed 15% cap, while aerospace components and aircraft remain exempt, creating mixed incentives for integrated manufacturing operations.

Although the tariffs and the trade agreement itself directly apply to goods, their broader economic effects extend into services and digital trade. Sectors such as logistics, finance, consulting, and software are closely connected to exports of goods. For example, higher tariffs on manufactured products can reduce overall trade volumes, indirectly shrinking demand for auxiliary services such as freight forwarding, customs brokerage, and export-oriented consultancy.

From Retaliation to Resolution: What Comes Next for Transatlantic Trade

The adoption of the 15% tariff ceiling marked a transition from a potential full-blown escalation to somewhat managed trade governance. While the agreement provides stability and predictability for businesses that have faced uncertainty, the future of the EU-US trade remains questionable.

Even though both sides indicated a willingness to maintain dialogue to address outstanding issues, such as steel and aluminium tariffs and market access concerns in agricultural sectors, as well as to strengthen cooperation on investment screening, supply chain resilience, and regulatory alignment, the geopolitical and economic environment will shape the future of trade, including the growing tension over the status of Greenland.

Economic pressures from third countries, such as China, which have their own trade dynamics with both the US and EU, as well as the EU partnership with Mercosur and India, will undoubtedly influence the trajectory of transatlantic trade. One additional factor that will determine trade between the EU and the US is the EU's digital regulations, including the Digital Services Tax, which US administrations have long criticised as disproportionately targeting US tech companies.

Source: European Parliament - US tariffs, VATabout - EU-US Trade Deal Sets 15% Tariff on Most Exports, VATabout - US-EU Trade Agreement: Tariff Cuts and Investments, World Economic Forum - US-EU trade deal, European Commission - EU-US trade deal explained, European Council - EU-US trade: facts and figures, European Commission - United States

Featured Insights

Burkina Faso FEC E-Invoicing Mandatory July 2026

🕝 February 24, 2026More News from Europe

Get real-time updates and developments from around the world, keeping you informed and prepared.

-e9lcpxl5nq.webp)

-ulcnia30z1.webp)

-3rcczziozt.webp)

-rvskhoqpms.webp)

-a5mkrjbira.webp)

-ivkzc1pwr4.webp)

-hssrwb5osg.webp)

-c06xa1wopr.webp)

-webajrr4ny.webp)

-evibmwdwcn.webp)

-7acdre0hop.webp)

-lcgcyghaer.webp)

-ol6mdkdowg.webp)

-aqdwtmzhkd.webp)

-njgdvdxe2u.webp)

-i6rki3jbad.webp)

-hdwgtama05.webp)

-atbhy5fyxv.webp)

-zp2n6zixoa.webp)

-oa1ynbm4sn.webp)

-lltkno6txy.webp)

-do38odrqnq.webp)

-t409oldqzt.webp)

-hordopb6xh.webp)

-ooimnrbete.webp)

-lwb5qpsily.webp)

-eumafizrhm.webp)

-mtqp3va9gb.webp)

-3ewrn1yvfa.webp)

-591j35flz2.webp)

-huj3cam1de.webp)

-hafis0ii23.webp)

-qseaw5zmcy.webp)

-qzsah2ifqx.webp)

-69rzooghib.webp)

-wrvng98m0g.webp)

-psucycuxh2.webp)

-klyo8bn5lc.webp)

-6wv5h5eyyd.webp)

-tfgg78rbid.webp)

-a6jpv9ny8v.webp)

-qhdbapy0qr.webp)

-owvu7zoc13.webp)

-h28jrh1ukm.webp)

-wl9bl1rw3a.webp)

-2w76jtvtuk.webp)

-c0uvrmrq9j.webp)

-pofe7ucwz3.webp)

-5cc23ezxyf.webp)

-rrmabbekeb.webp)

-iyyeiabtaf.webp)

-c8rbjkcs01.webp)

-nilkffjhah.webp)

-hikakq55ae.webp)

-z1d60bldtg.webp)

-d1a0q6n7mp.webp)

-viip8nvoeh.webp)

-bvv1otliox.webp)

-de8hdb1bn3.webp)

-7xsxxoypnx.webp)

-cm0opezg73.webp)

-0tovsdupmi.webp)

-subxdamdj6.webp)

-gly6ablwnh.webp)

-gkduqhwbzh.webp)

-qpe1ld9vcj.webp)

-8noukwsmba.webp)

-aka29tuhkt.webp)

-fisvs27yrp.webp)

-mp0jakanyb.webp)

-aivzsuryuq.webp)

-o7f4ogsy06.webp)

-zjja92wdje.webp)

-hrbhdts8ry.webp)

-qtdkwpgkug.webp)

-cf8ccgah0p.webp)

-0em3cif5s6.webp)

-ptzesl0kij.webp)

-tfzv42pyms.webp)

-uodv7sfbih.webp)

-bbrdfmm9qf.webp)

-m2tl8crfqr.webp)

-1awbqjgpjs.webp)

-avbjsn1k1g.webp)

-0h8ohkx6s0.webp)

-wfmqhtc7i6.webp)

-7wljbof2zo.webp)

-eqt97uyekl.webp)

-wzw9mcf563.webp)

-z4oxr6i0zd.webp)

-l0zcrrzvhb.webp)

-fhtic1pwml.webp)

-iipdguuz9p.webp)

-nkhhwrnggm.webp)

-pltqwerr3w.webp)

-nn6mtfbneq.webp)

-tmnklelfku.webp)

-8z1msbdibu.webp)

-7g16lgggrv.webp)

-lxcwgtzitc.webp)

-9mc55kqwtx.webp)

-xla7j3cxwz.webp)

-jrdryw2eil.webp)

-t9qr49xs2u.webp)

-qjopq5jplv.webp)

-vune1zdqex.webp)

-qsozqjwle2.webp)

-rgjta7iwiv.webp)

-zb6bxxws47.webp)

-lyfjzw4okp.webp)

-ogpfmol5m1.png)

-czisebympl.png)

-zetvivc79v.png)

-ud7ylvkade.png)

-qizq6w2v5z.png)

-ihr6b4mpo1.webp)

-k1j4au0ph6.webp)

-swxxcatugi.webp)

-ig9tutqopw.webp)

-tauoa6ziym.webp)

-spr0wydvvg.webp)

-xfuognajem.webp)

-u2nv5luoqc.webp)

-opuxpan2iu.webp)

-kwttsfd8ow.webp)

-8u14qi10nj.webp)

-wjpr96aq5g.webp)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)